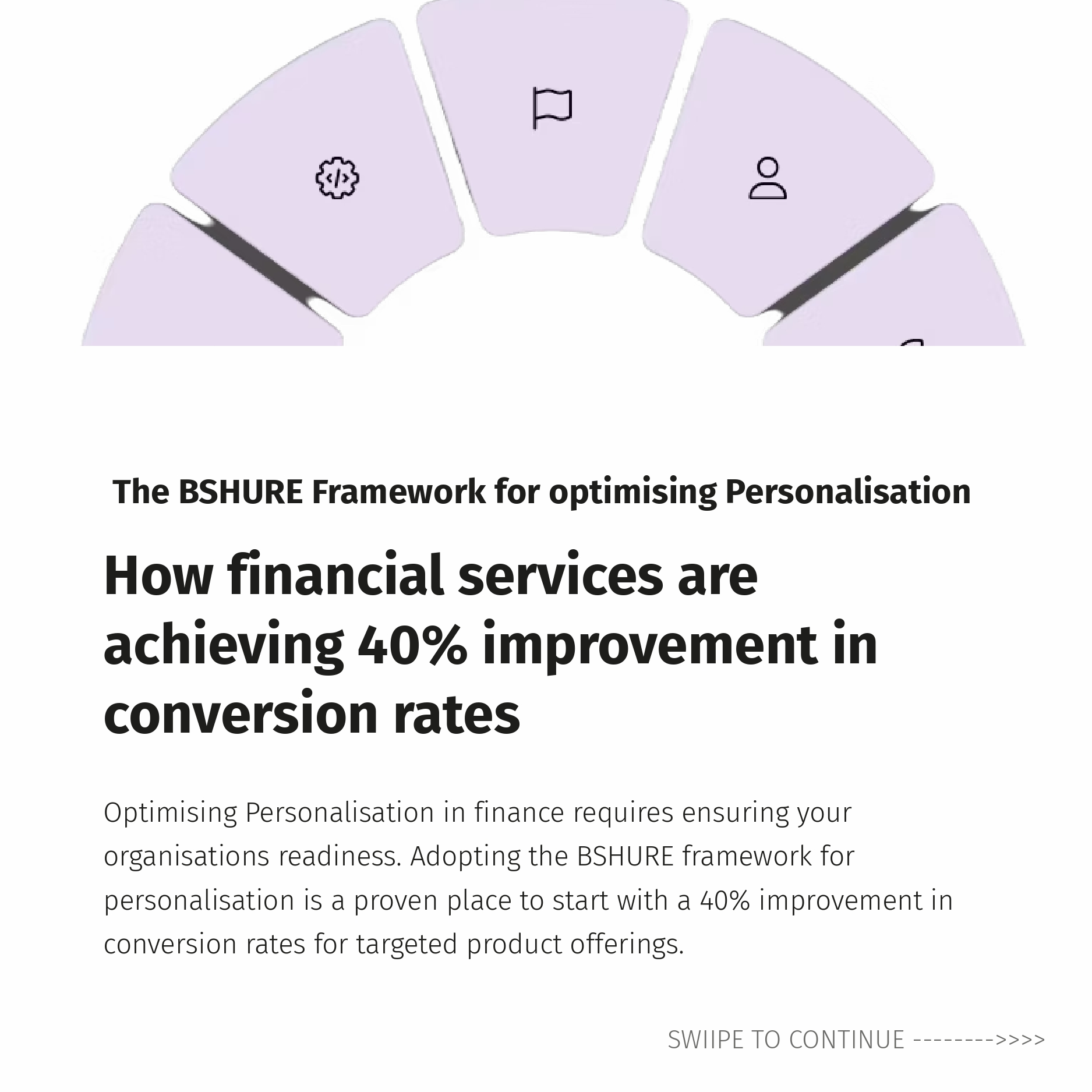

Hyper-personalisation - "The Next Frontier in Digital Transformation" according to IBM - is set to grow from $38bn to $190bn by 2030.

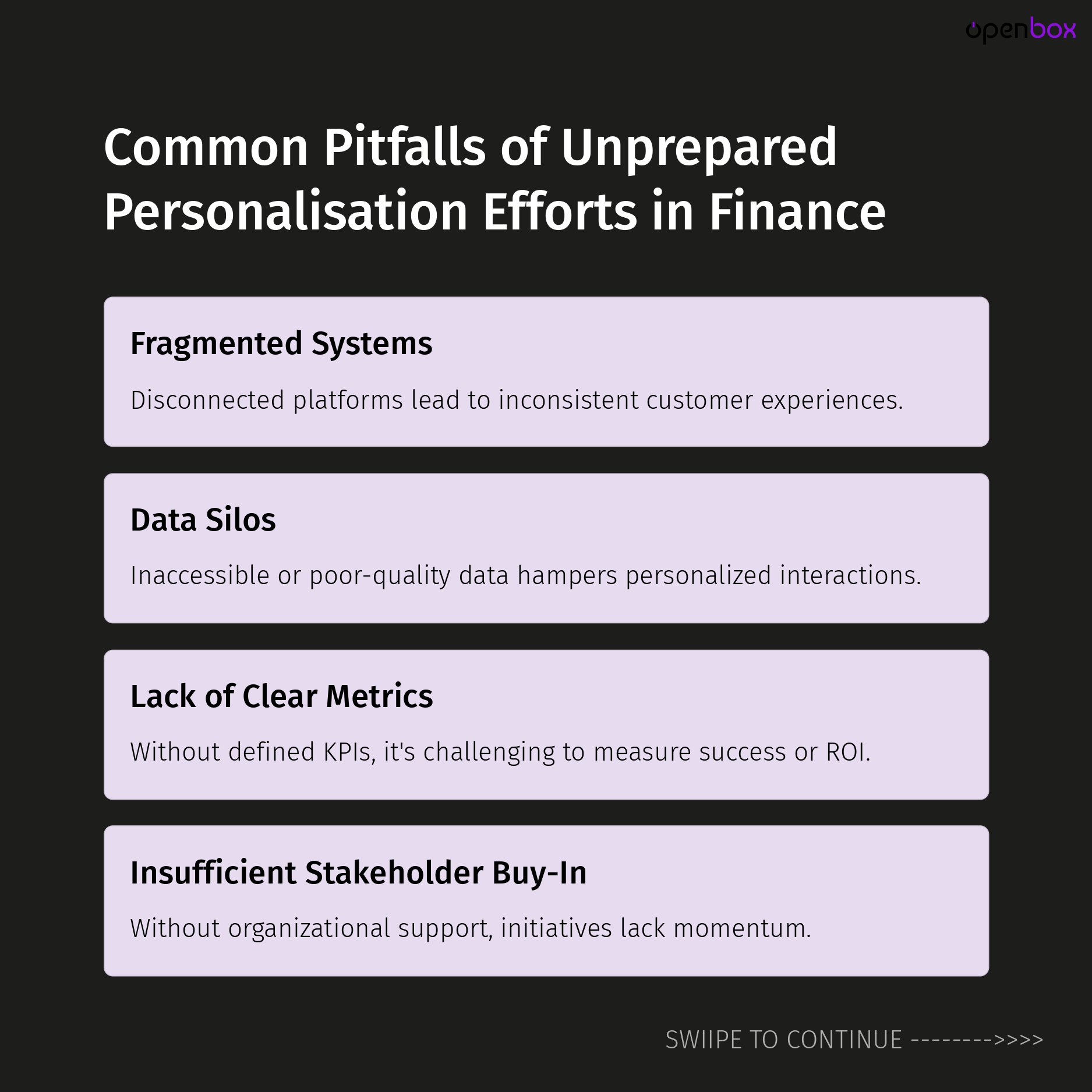

However, there is heightened risk that comes with hyper-personalisation – if an institution gets it wrong, it can cause a lot of damage and can come across as creepy.

But with the high street all but dead and an increasing desire for more tailored online experiences from banking and insurance customers alike, how are digital transformation leaders in finance rising to the personalisation challenge?

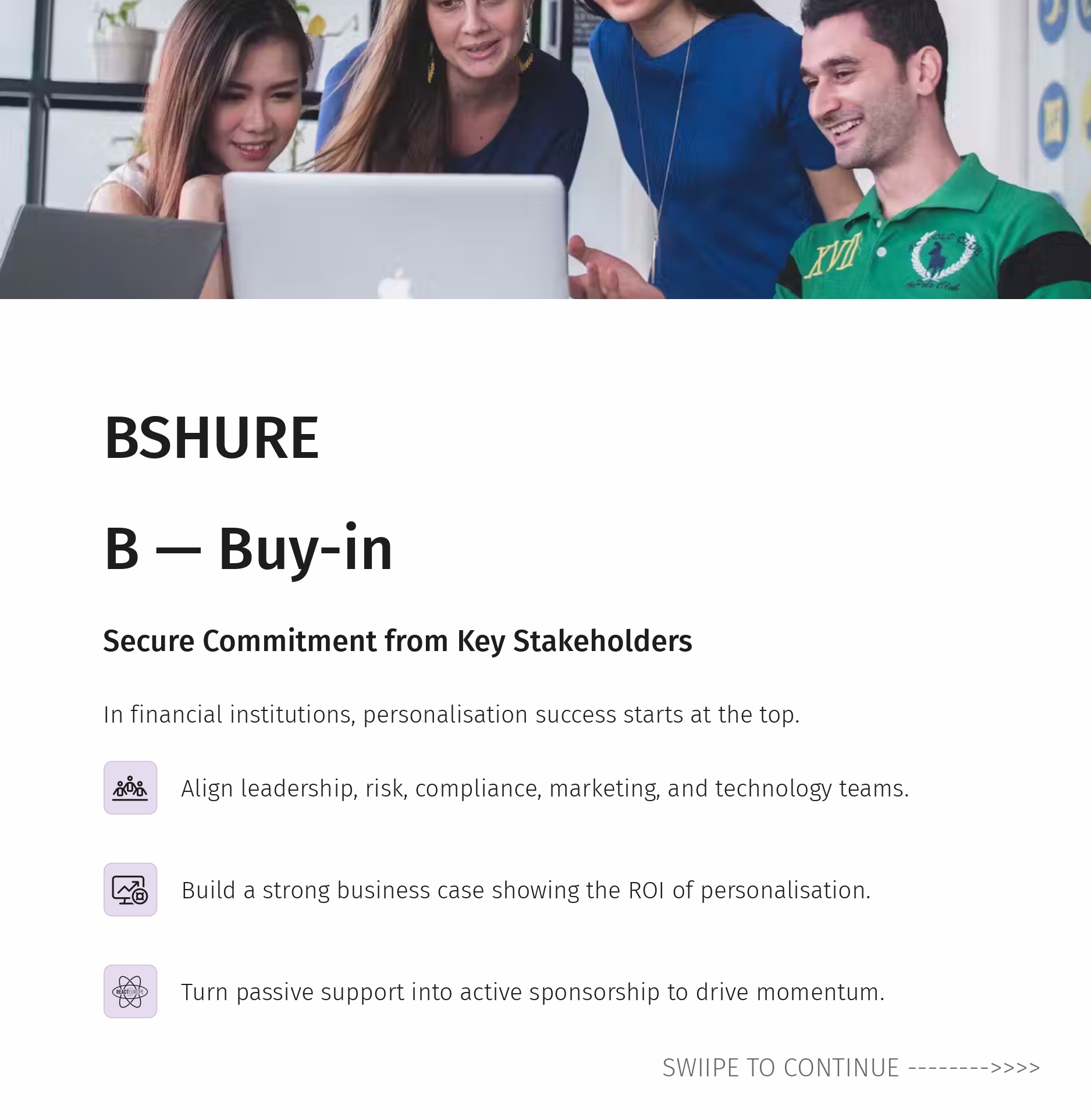

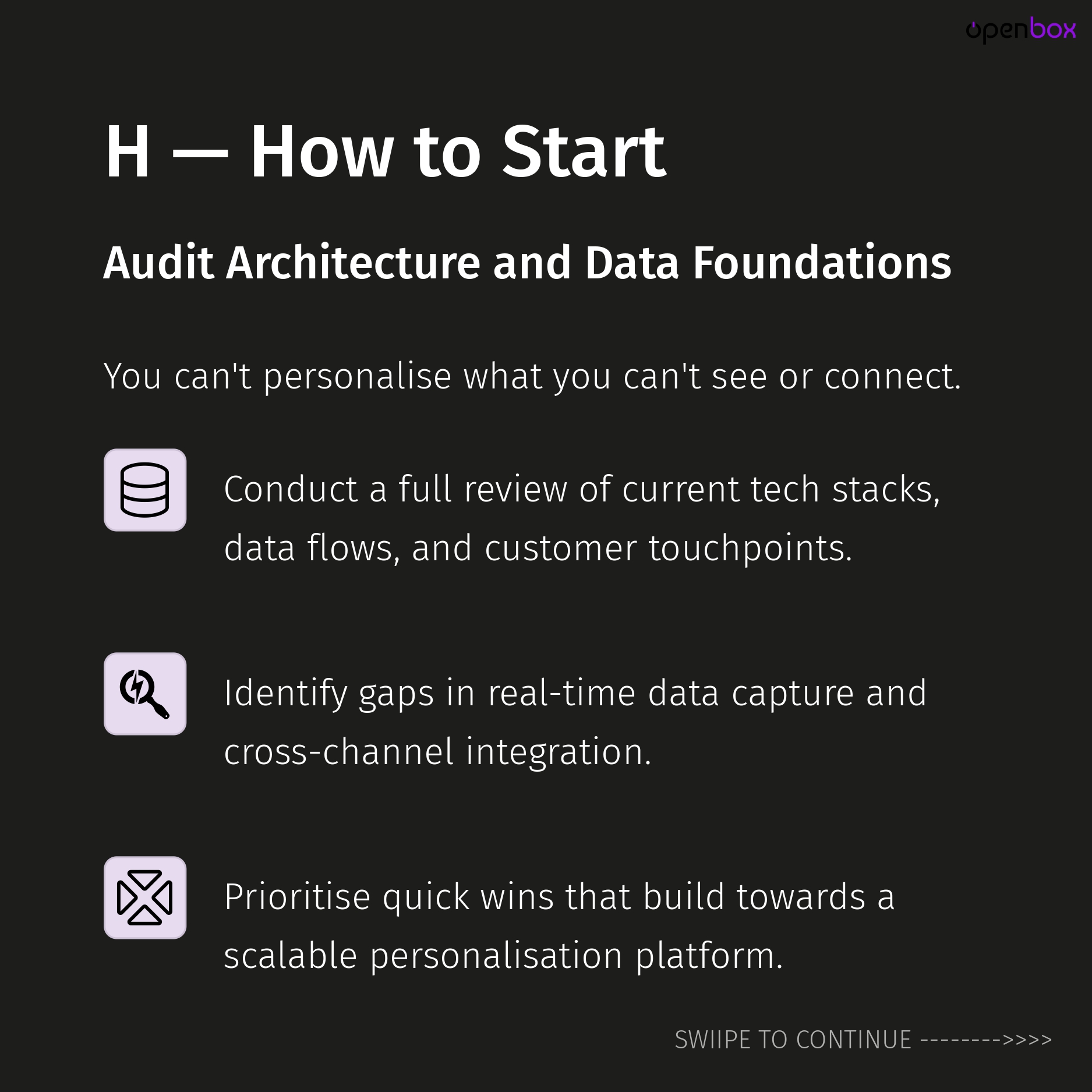

Check out the personalisation missteps to avoid and download the framework that is delivering a 40% increase in online conversions in the finance sector through personalised customer experiences.

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0001

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0002

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0003

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0004

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0005

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0006

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0007

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0008

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0009

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0010

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0011

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0012

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0013

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0014

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0015

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0016

- Make Banking Personal Again Linkedin Carousel Pages To Jpg 0017